Social security calculator for married couples

Same-sex married couples have enjoyed the same rights as. Taxes on Social Security.

The 2020 Guide To Social Security Spousal Benefits Simplywise

Those who earn more than that might qualify for the exemption if theyre disabled.

. A good retirement calculator will give you separate fields one for you and one for your spouse or partner for each of the following topics. Questions a Retirement Calculator for Couples Need to Ask. This calculator estimates Social Security benefits for single people who have never been married for married couples and for divorced individuals whose marriage lasted at least 10 years and who.

Here are tips for finding and using a retirement calculator for married couples or any couple. When a name changes through marriage it is important to report that change to the Social Security Administration SSA. Use the Social Security calculator to estimate your pre-retirement earnings and when you can collect benefits to maintain your standard of living.

August 31 2022 You Could Pay. Benefits for Married Couples. This multiplies to a total of 525000 saved.

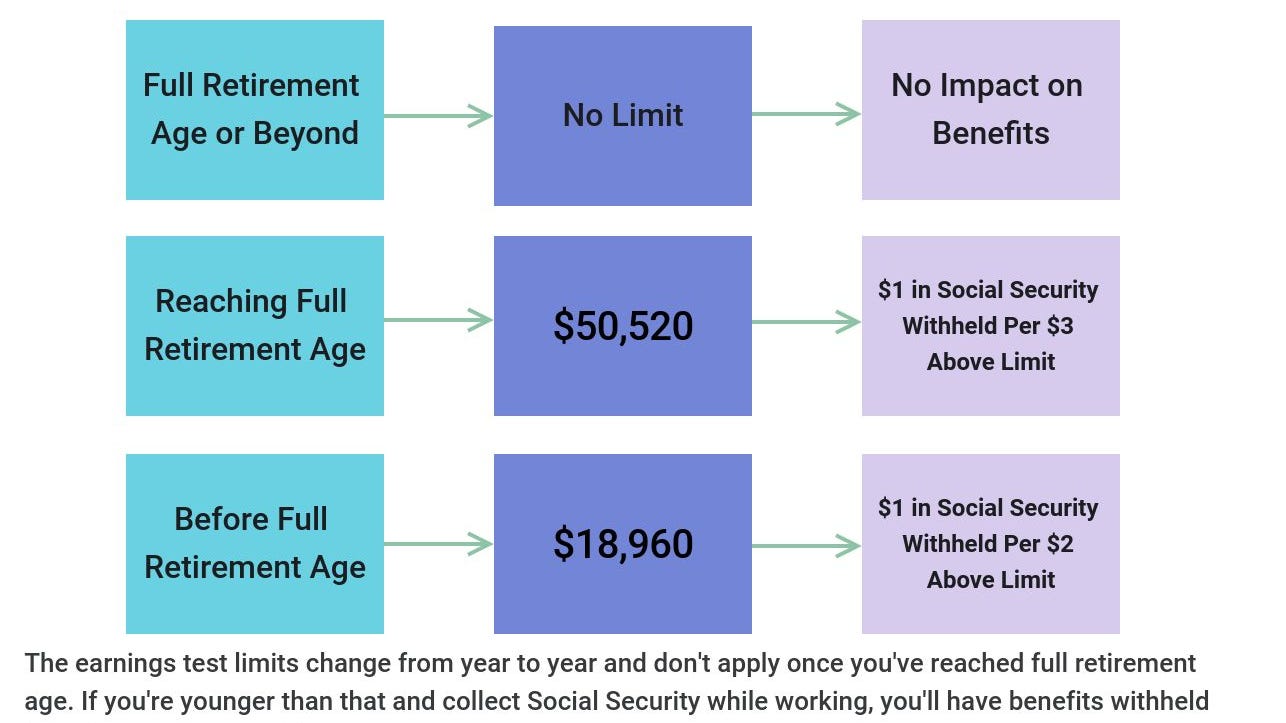

Some individual states also tax Social Security income. The Bipartisan Budget Act of 2015 closed two Social Security spousal benefits loopholes mainly used by married couples. View office hours directions phone number and more.

Best Ways To Protect Your Social Security Number. A portion may be taxable if your AGI exceeds 100000 for married. The actual social security benefit that you receive must be calculated under the provisions of the Social Security Act Cap.

Social Security start dates and benefit. Heres a checklist of items for newly married couples to review. Many of them unfortunately are relatively simple linear progressions with only limited ability to input variables.

But more than half of Americans who receive Social Security benefits owe taxes on that income come tax day. August 31 2022 Social Security for Married Couples. If it doesnt it could delay any tax refund.

Childrens Allowance Calculator Childrens Allowance is awarded to married couples. The COLA for 2023 will be announced on October 13. The exact amount of your Social Security benefit you pay taxes on depends on your total income but it caps out at 85 of your benefits.

A Social Security online calculator shows you the percentage of. Financial experts say that a couple aged 60 with a dual income of 75000 per year should have seven times their household income in their retirement account. Life Expectancy Calculator Posted on May 30 2020.

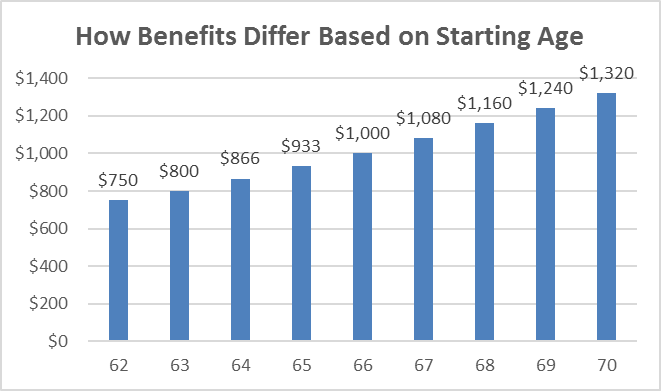

Social Security benefits are a key source of income for retirees. SmartAssets Social Security calculator will help you estimate how much of a benefit. They view the decision as if they were single which means that the main factor they consider is their break-even ageInstead they should be looking at the joint life expectancy of both partners.

You have to be married at least one year to collect on your new spouses Social Security earnings record but can still collect on your former spouses if higher if you were married at least. Cost Of Living Adjustment COLA. Separated parents or returned migrants having the care and custody.

Consider these Social Security claiming strategies. Make sure you check your state laws. There are several versions of tools available to help you determine your life expectancy.

In 2023 Social Security beneficiaries will likely see a 97 COLA in their monthly Social Security benefits the biggest increase since 1981. Mobile Social Security Office located at 550 Government St Mobile Alabama 36602. Deemed filing Prior to the law change people who were eligible for earned benefits and spousal benefits were required to file for both at the same time a practice known as deemed filing.

For married people only considering monthly checks in. Retirement Savings Benchmarks for Married Couples. Social Security will pay you the bigger of the two amounts never both combined.

Name and address changes. The name on a persons tax return must match what is on file at the SSA. Married couples often make a big mistake when it comes to deciding when to start taking their Social Security benefits.

Work 35 or more years. Missouri exempts Social Security benefits from state tax provided that the individual is age 62 or older and has adjusted gross income of less than 100000 if married and filing jointly or 85000 for all other filing statuses. A Social Security calculator can help you run the numbers to determine the best age to claim Social Security.

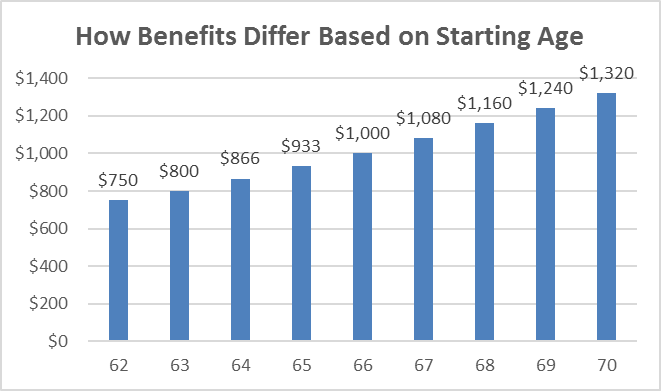

Under Social Securitys deemed filing rule people who are married are required to file for a spousal benefit at the same time as they file for their retirement benefit when you claim one you are deemed to be claiming the other. The limit is 32000 for married couples filing jointly.

5 Key Things To Know About Social Security Retirement Benefits Retirement Benefits Social Security Benefits Social Security

The Best Age To Begin Collecting Social Security Retirement Benefits Balentine

A Comprehensive Guide To Social Security After Divorce

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

What Is Deemed Filing And How Does It Affect Social Security Find Out

When Are You Money Ahead On Social Security Morningstar

Social Security Calculators That Can Help You Decide When To Claim Vermont Maturity

Social Security Benefits Tax Calculator

The 2020 Guide To Social Security Spousal Benefits Simplywise

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

The 2020 Guide To Social Security Spousal Benefits Simplywise

What Are The 2021 Social Security Earnings Test Limits

How Much Social Security Does A Non Working Spouse Get Goodlife

Social Security Tips For Married Couples Vanguard

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Money Sense Tax

Estimate Your Social Security Benefit Retirement Planning Fidelity